OUR SERVICES

PROFESSIONAL TAX PREPARATION

Individual Tax Preparation: Expert tax filing services ensuring you utilize all eligible deductions and credits to maximize your returns effectively.

MENTORSHIP

Expert support for small businesses, ensuring tax compliance and leveraging strategies to optimize financial outcomes throughout the year.

CONSULTATION

Expert guidance and representation during IRS audits, helping minimize liabilities and navigate complex issues effectively.

Ready to get started?

OUR TEAM

Behind Every Success is a Dedicated Team

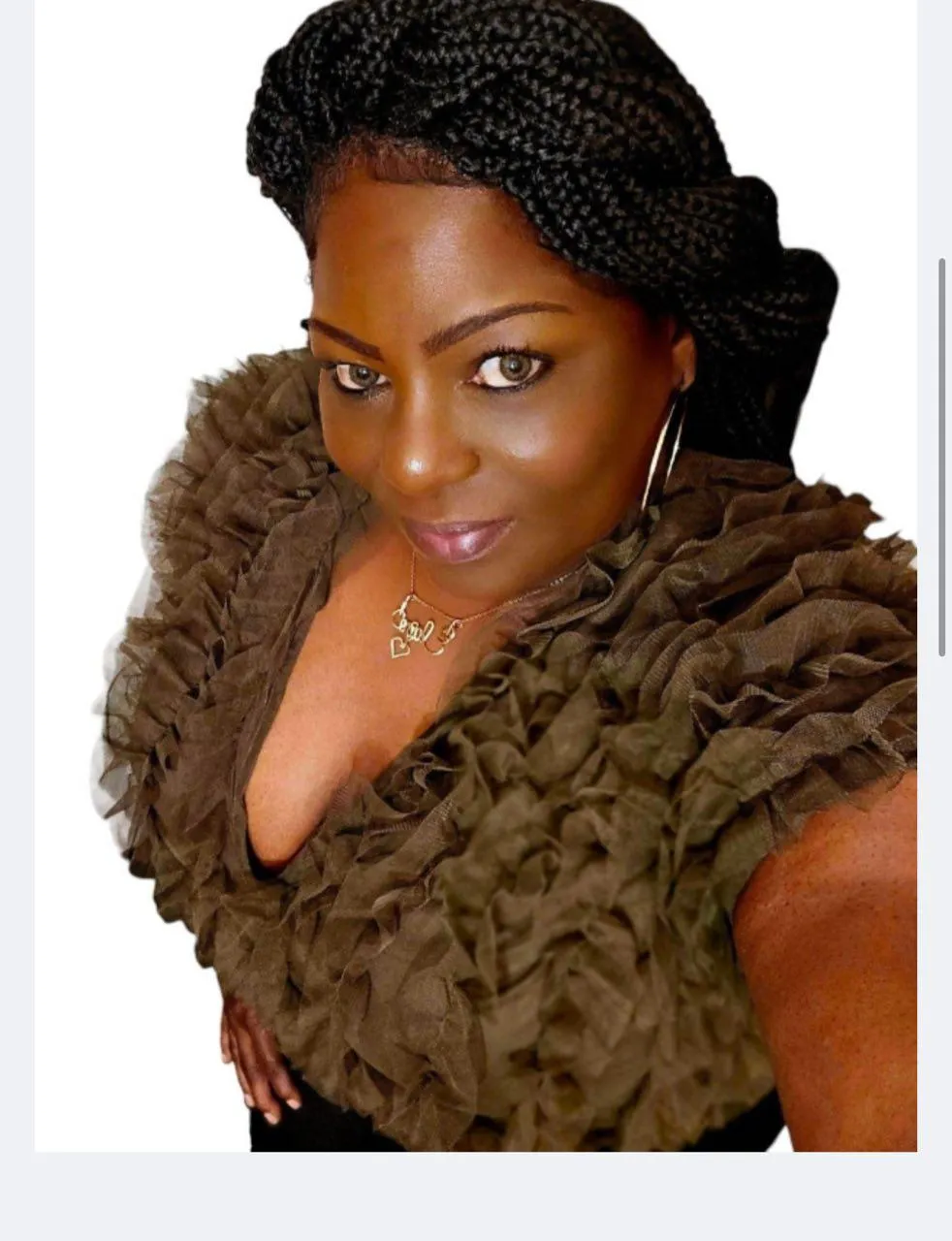

Shamaria

Woods

CEO

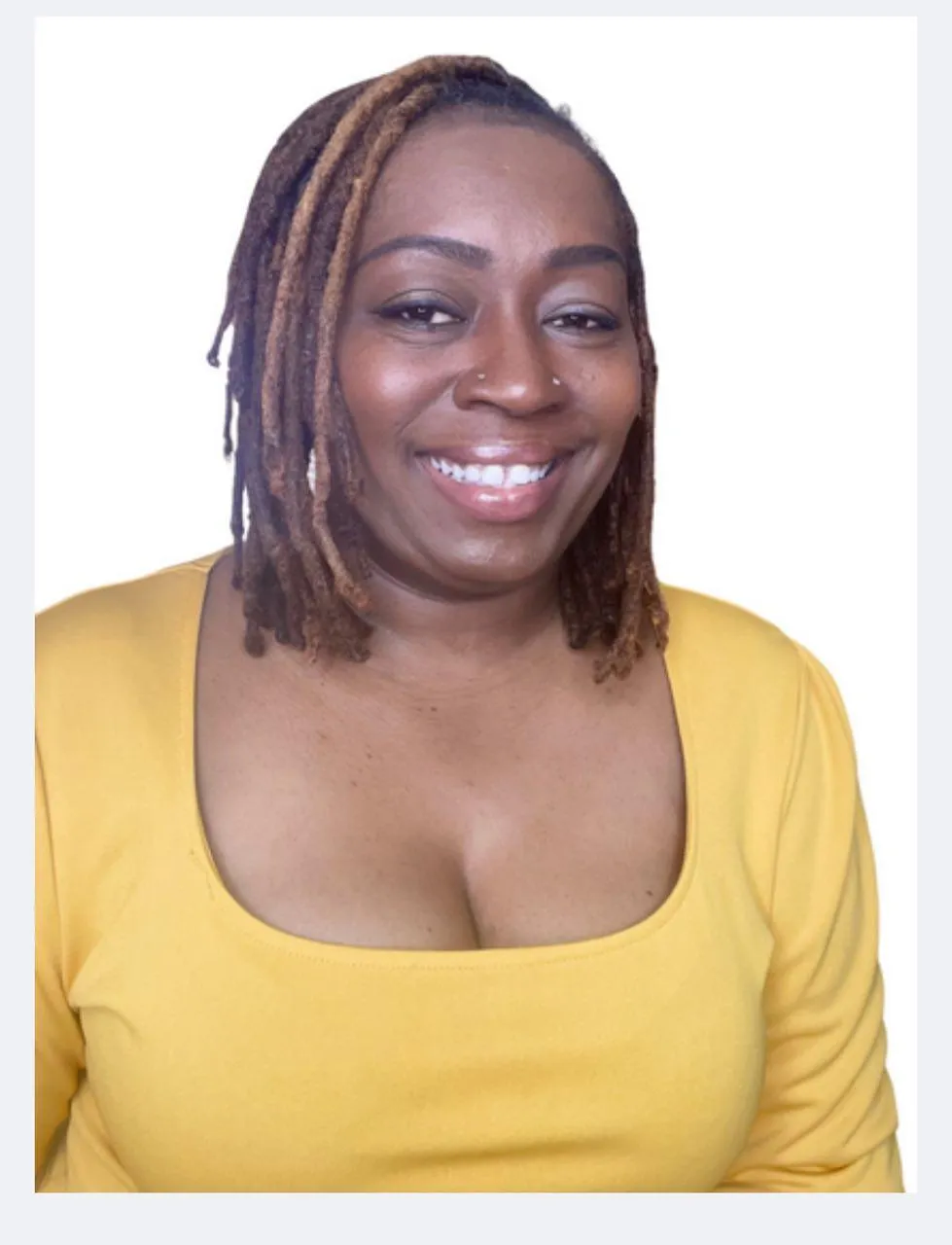

Elaine

Grimes

Tax Professional

Genesis

Mendez

Tax Professional

Shameka

Gant

Tax Professional

Joyce Sturdivant

Tax Pofessional

Liz Cook

Tax Professional

La Tisha Spears

Tax Professional

Laquita Tomas

Tax Professional

Charde Wallace

Tax Professional

Frequently Asked Questions

Question 1: What documents do I need to file my taxes?

You’ll typically need photo ID, Social Security cards (or ITIN letters), last year’s tax return, W-2s, 1099s, and any documents related to income, deductions, or credits.

Question 2: How much does it cost to prepare my taxes?

Tax preparation fees vary based on the complexity of your return. Pricing is discussed upfront before we begin—no hidden fees.

Question 3: How long does it take to receive my tax refund?

Most refunds are issued within 7–21 days after the IRS accepts your return, depending on your filing method and whether you choose direct deposit.

Question 4: Can you help if I’m self-employed or own a business?

Yes! We specialize in self-employed, small business, and independent contractor tax returns, including Schedule C, deductions, and quarterly estimates.

Question 5: What if I owe taxes or have past-due returns?

We can help with back taxes, payment plans, and IRS correspondence. Our goal is to minimize penalties and get you back into compliance.